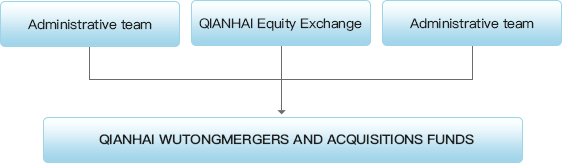

Established in March 2014, QIANHAI Wutong Mergers and Acquisitions Funds (“QHMA”) is a fast growing firm featuring in Mergers and Acquisitions, Equity Exchange and Fund Management. QHMA leverages on QIANHAI Equity Exchange’s (one of its solid shareholders) strong support, its own professional administrative team and foresighted investment concept, to carry out comprehensive cooperation with listed companies and provide them with a variety of financial services.

Internet, Information technology, Health, Energy saving and environmental protection, Cultural and entertainment, Industrial automation, Military;

Shareholder structure

Assets under management

Currently (as of june.2017), QHMA (including its subsidiaries) manages

with a total funding scale of approximately

Invested enterprise

Assets under management

While QHMA maintains the strength of a “founder culture”, we have grown with a focus on creating a long lasting investment firm. We are proud to have a deep bench of experienced leaders and investor teams.

Core competitiveness and strengths

1.Powerful shareholders

Qianhai Equity Exchange (“QHEE”) is renowned as the most distinguished local equity exchange platform in China. As QHMA’s substantial shareholder, QHEE exerts significant influence with the input of multiple resources from projects, industries, finance and government.

2.Industry Expertise/Sourcing

Over 70% of the personnel are talents professional in both industry and investment, respectively from ZTE, Huawei, SoftBank, Morgan Stanley, JD Capital and other well-known enterprises/financial institutions alike.

Main businesses are well-supported by an expert supporting team composed of financial, legal, human resources and administration specialists.

3.Cooperating between the funds and partners

Funds established with each listed company may share a common interest to one case, especially in the sectors like AI, big data, consumer upgrading, etc., more than one fund will be engaged to one invested company.

One project investment match more fund interest, more exit possibilities conclude a better result to its investors.

Open partner relationship s with institutes like China Renaissance, IResearch Global, etc., to build an Eco-Economy environment.

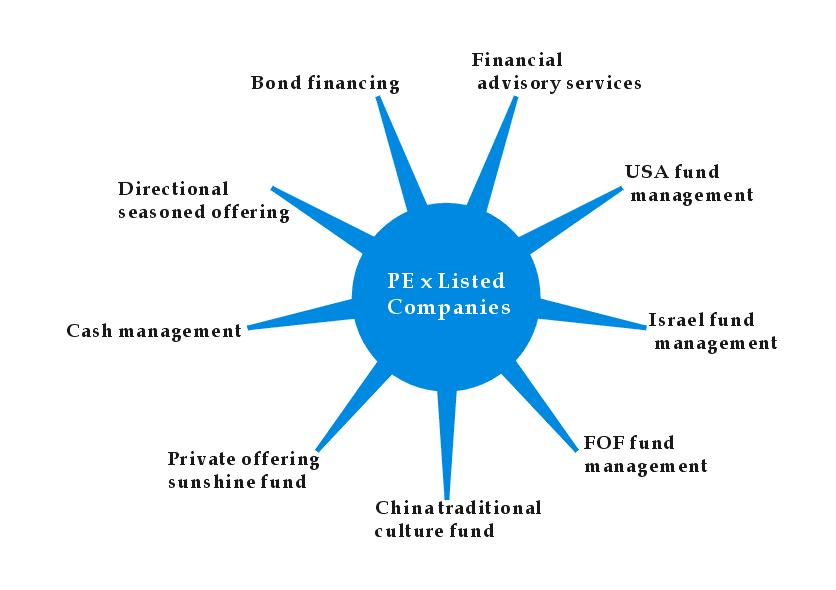

“PE x Listed Companies” Business Mode

QHMA has so far announced formal collaboration with 8 listed companies by co-launching over 8 M&A funds, which promotes formulation of its unique investment mode: “PE X Listed Companies.” More comprehensive business collaboration has continually been carried out among listed companies and QHMA in a way of co-investing quality target firms, hence the industrial ecological synergy.

With advanced concept and rich resources, QHMA provides full-range and one-stop services for listed companies, as shown below, which greatly enhance our corporation and find it a win-win solutions to all parties.

Won the "Golden Eagle Award" - "the most growth of venture capital institutions"

President Xie Wen Li won the venture "Golden Eagle Award" - "cutting-edge venture capitalist"

Won the "top 2016 China's best-funded Chinese private equity investment institutions top50"

Won the "top 2016 China's best private equity investment institutions top100"

President Xie Wen Li was "hit in Hurun 2016 China's best private equity investors TOP50"

And the seventh listed company - Julong shares (300202) co-sponsored Juluo Wutong M & A fund

July 2016And the sixth listed company - Jiachuang video (300264), jointly set up Jia Chong Indus M & A Fund, focus on cooperation in the strategic strategy of listed companies

With the top advisory body launched Indus vertical and horizontal

Debut the ninth China (Shenzhen) Jin Fair, hosted the "asset allocation era of the new asset allocation program"

Company B round of financing was officially launched, valued at 1.1 billion yuan

And the third listed company - Carolina Life (002293) cooperation launched intelligent life technology mergers and acquisitions fund

With a number of well-known third-party financial institutions issued parallel parent fund

The company was born in the former sea, the registered capital of 10 million yuan

Won the hunting cloud network "2016 CEO Summit Annual Industrial Investment Fund"

Won the "2016 Chinese brand influence (financial industry) top ten enterprises"

And the eighth listed company - grams Ming Mianye (002661) cooperation in the establishment of grams of Indus industry investment and mergers and acquisitions fund, a comprehensive into the large consumer areas

2016 China Economic Development Forum "2016 new economy, new kinetic energy, new model - model enterprises"

In the China Association and the support of the Xinhua News Agency, as "China's old investment Union" chairman of the unit

And CCTV securities information channel jointly build "Indus observation" program

Held the first China Equity Investors Conference

And the fifth listed company - Storm Technology (300431) co-sponsored cultural industry mergers and acquisitions fund

Won the CCTV Securities Information Channel Fifth China Investors Conference issued by the "China's investment and financing industry leading brand"

And the fourth listed company - the United States and Asia Park (300,188) cooperation in large data and cyberspace security merger

As "the investment group in 2015 China's most innovative Chinese-funded private equity investment institutions"

And the first listed company - Shenzhou Taiyue (300002) cooperation launched mobile gaming industry mergers and acquisitions fund

And the second listed company - Teng State International (300,178) cooperation launched online tourism industry M & A fund

Internet

Healthcare

Informatization

Energy Saving and Conservation

Culture and Entertainment

Industrial Automation

Military to civilian use

to build the core competitive beyond just capital, asssist in the growth of entripse, and investment changes our life enoromuously.

A thoughtful capital

joint high quality listed company,

builds core competencies beyond capital,

and is committed to investing in changing future life.

Not the same equity investment to

create "PEX listed company" model

for listed companies to provide one-stop purchase of solutions to

build a listed company's ecological alliance.

2014 years before the sea Billboard best investment fund

President Xie Wen Li was the top ten innovation youth before 2014

China 's investment and financing industry leader in 2015

Won the group in 2015 China 's most innovative Chinese - funded private equity investment institutions

"2016 China's new economy, new kinetic energy, new model - model enterprises"

President Xie Wen Li won the "2016 China's new economy, new kinetic energy, new model - model

"2016 Chinese brand influence (financial industry) top ten enterprises"

President Xie Wen Li won the "2016 Chinese brand influence (financial industry) ten leading figures"

Invested in 2016 China 's Best Chinese Private Equity Investments

2014 years before the sea Billboard best investment fund

President Xie Wen Li was the top ten innovation youth before 2014

China 's investment and financing industry leader in 2015

Won the group in 2015 China 's most innovative Chinese - funded private equity investment institutions

"2016 China's new economy, new kinetic energy, new model - model enterprises"

President Xie Wen Li won the "2016 China's new economy, new kinetic energy, new model - model"

"2016 Chinese brand influence (financial industry) top ten enterprises"

President Xie Wen Li won the "2016 Chinese brand influence (financial industry) ten leading figures"

Invested in 2016 China 's Best Chinese Private Equity Investments

Sweep away

immediately concerned about the WeChat public number

Sweep away

immediately concerned about the WeChat public number